AB Direct - Steers

Rail: ---

AB Direct - Heifers

Rail: ---

US Trade- Steers

Rail: ---

US Trade - Heifers

Rail: ---

Canadian Dollar

0.10

Western Canadian cattle dynamics impacted by tariffs

Market fundamentals continue to point to a bullish outlook for the Canadian beef industry in 2025, though significant volatility has already been noted. Feeder cattle contracts responded negatively to the imposition of tariffs on April 2, with the April contract declining 1,100 points by April 7. Stock and futures markets remained on the defensive as of the middle of April due to the changing tariff landscape.

The Canadian cattle herd on January 1, 2025 was down 1 per cent from 2024, with beef cows down 1.2 per cent, steers down 2 per cent, and heifers for slaughter down 1 per cent. Calves were steady with 2024 while beef heifers for breeding were up 1 per cent. However, the increase in beef breeding heifers was not able to offset the decline in the beef cow herd. Weather, competition for pastureland, and aging producer demographics appear to be limiting factors. The U.S. cattle herd also continues to contract.

Western Canadian auction volumes swung wildly during the first 14 weeks of 2025 as cattle were marketed ahead of impending tariff deadlines. Auction volumes were historically high during the second half of January and spiked ahead of tariff implementation deadlines in March and April. Year-to-date western Canadian auction volumes are 3 per cent larger than last year.

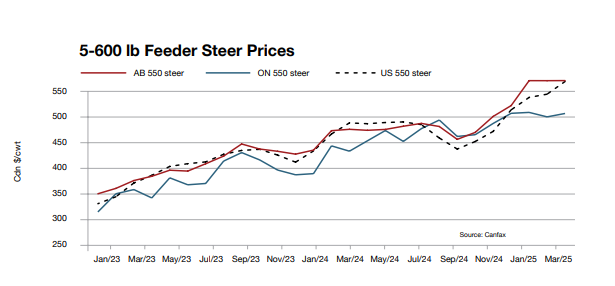

The calf market has been moving mostly sideways in both Alberta and Ontario during the first quarter of 2025, with some downward pressure noted in Ontario in February. At the same time, U.S. steer calves have continued to move higher, narrowing the discount against the Alberta market. Alberta 5-600 lb steer calves averaged $522/cwt in the first quarter, up 27 per cent from the first quarter of 2024. Ontario steer calves averaged $456/cwt in the first quarter with U.S. steer calves at C$502/cwt. Alberta steer calves averaged a $66/cwt premium against their Ontario counterparts and a $20/cwt premium to the U.S. March was the sixth consecutive month that Alberta 5-weight calves were at a premium to Ontario and the ninth consecutive month the Alberta calves were at a premium to the U.S.

Alberta cull cow prices moved inconsistently higher through the first quarter, and similar to the feeder and fed markets, remain subject to tariff volatility. Alberta D2 cows averaged $194/cwt in the first quarter, up 35 per cent from last year. U.S. Utility cows have kept pace, averaging C$196/cwt while Ontario D2 cows were at a $25/cwt discount, averaging $169/cwt. Cull cow prices dipped ahead of both the March 4th and April 2nd deadlines but recovered as tariffs against CUSMA compliant products were exempted.

With the North American cattle cycle contracting and retail prices rising, there remains the question of demand holding up. For ongoing market analysis and to become a Canfax member, visit canfax.ca.

This article was first published in Volume 5 Issue 2 of ABP Magazine (May 2025). To access the full digital magazine or subscribe to the print edition, click here.