AB Direct - Steers

Rail: ---

AB Direct - Heifers

Rail: ---

US Trade- Steers

Rail: ---

US Trade - Heifers

Rail: ---

Canadian Dollar

0.17

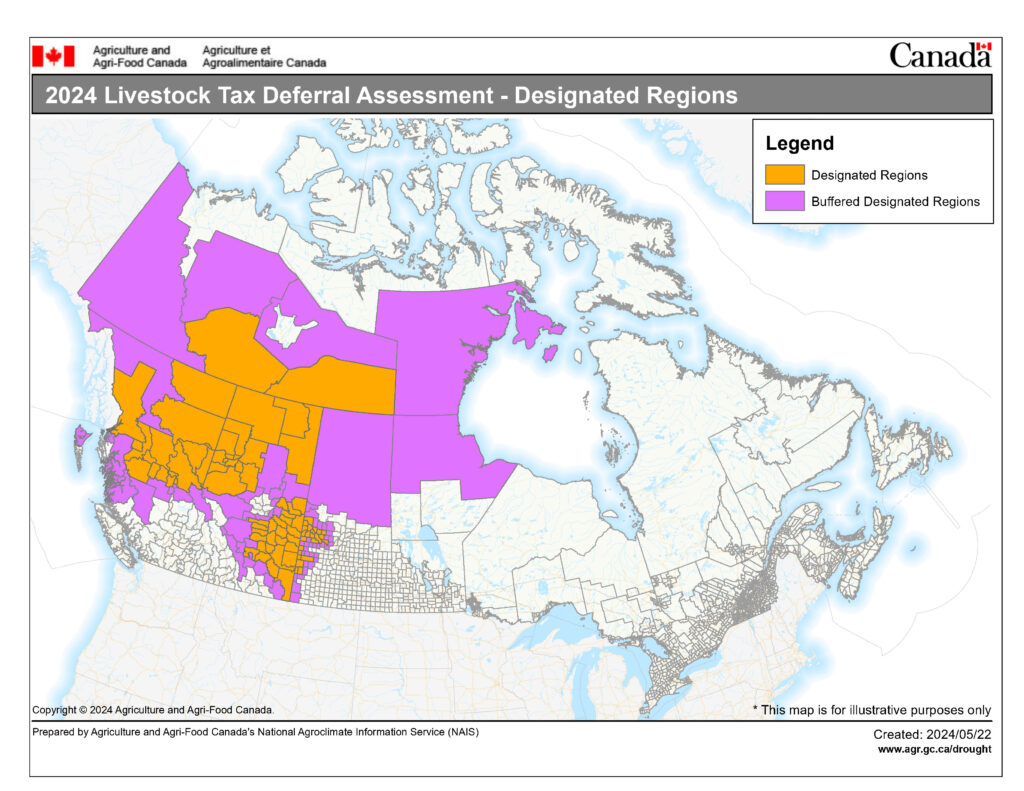

Minister MacAulay announces early list of Livestock Tax Deferral regions

To provide producers with more certainty heading into the summer months, Minister of Agriculture and Agri-Food Canada (AAFC), Lawrence MacAulay, is announcing an early list of regions that are eligible for Livestock Tax Deferral in 2024.

“As a farmer myself, I know firsthand the challenges and uncertainty our producers face due to extreme weather,” says Minister MacAulay. “By announcing Livestock Tax Deferral regions earlier in the year, and applying buffer zones to increase flexibility, we’re helping farmers make informed decisions and build up their resilience.”

The Livestock Tax Deferral provision allows livestock producers in certain areas who are forced to sell all, or part of their breeding herd to due to drought, flooding, or excess moisture to defer a portion of their income from sales until the following tax year. This deferral helps reduce the tax burden associated with the original sale. The income may be at least partially offset by the cost of reacquiring breeding animals.

This year, The Government of Canada has streamlined the process to identify regions earlier in the growing season. Additionally, a buffer zone has been instituted to adjacent regions to capture impacted producers on the edges of affected areas.

After consultation with industry, AAFC used preliminary scientific data to produce the initial list of prescribed regions earlier in the growing season.

Once a region is prescribed, it will remain eligible for the deferral for the taxation year.

Weather, climate, and production data from access Canada will continue to be monitored throughout the remainder of the season, and regions will be added to the list when they meet the criteria.

You can find the 2024 Livestock Tax Deferral, Prescribed Regions, here.