AB Direct - Steers

Rail: ---

AB Direct - Heifers

Rail: ---

US Trade- Steers

Rail: ---

US Trade - Heifers

Rail: ---

Canadian Dollar

0.16

Fed and feeder markets take a breather, calves remain strong

This past year has been a challenging one with high feed prices. Severe drought in the U.S. corn belt and the Midwest U.S., as well as global food concerns due to the Russia/Ukraine conflict, resulted in record high prices barley prices this spring when prices touched $475/tonne in May. A brief reprieve occurred in July and August as prices dipped to be relatively cheap at $365/tonne. Feedlot producers who locked in at that price will have considerable advantage for fed cattle profitability than those who waited as October barley prices rebounded back to $460/tonne.

Alberta 550 lb steer prices remain historically strong. Prices dipped for four consecutive weeks at the beginning of September from the annual high of $274/cwt, but have since rebounded, finding a price ceiling at $267/cwt in October. Third quarter 550 lb steer calf prices are 13 per cent higher than last year, averaging $253/cwt. Alberta 850 lb feeder steers found resistance near $240/cwt and have trended sideways since the end of August. Third quarter 850 lb steers are 17 per cent higher than last year, averaging $225/cwt.

In addition, the cull cow market has been strong this fall, with Alberta D1,2 cows averaging $109/cwt for the third quarter, 23 per cent higher than the five-year average for the third quarter. At $102/cwt in October, D1,2 cow prices are 42 per cent higher than last year.

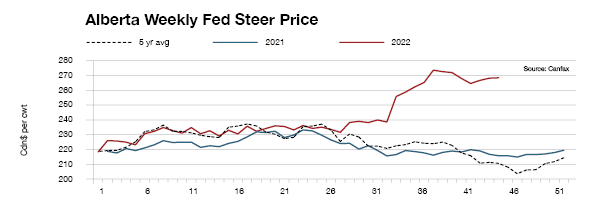

Alberta-fed cattle prices have moved higher for almost the entire year, though the Canfax Trends report indicates prices are still shy of breakeven. An 850 lb steer placed in April and marketed in October had a breakeven of $184.66/cwt live; but the cash price was $180.63/cwt. Simple hedging has not provided feedlots with consistent profit opportunities, as more sophisticated risk management strategies are needed.

Alberta-fed steer carcass weights in the third quarter were record large, at 920 lb; 11 lb heavier than the third quarter of 2021 and 18 lb heavier than the five-year average. This is unfortunate, as heavier-weight cattle are preventing price leverage from moving to feedlots and weakening the basis. The October cash-to-futures basis was $22.57/cwt. The year-to-date Alberta cash-to-futures basis is $8.15/cwt, the weakest since 2014. The U.S.-fed market is expected to have tighter supplies in the next few months, encouraging Canadian-fed cattle exports south.

The decline in the Canadian dollar encouraged fed cattle exports. From June to October, the Canadian dollar lost 6.5 per cent of its value, to close October at USD$0.73. Year-to-date Canadian fed cattle exports are 36 per cent higher than last year and 14 per cent higher than the five-year average, at 217,193 head.

For ongoing market analysis and to become a Canfax member, visit www.canfax.ca

This article was first published in Volume 2 Issue 5 of ABP Magazine (December 2022). Watch for more digital content from the magazine on ABP Daily.