AB Direct - Steers

Rail: 535.00-539.00 del

AB Direct - Heifers

Rail: 535.00-539.00 del

US Trade- Steers

Rail: 375.00-376.00 * few (IA, NE)

US Trade - Heifers

Rail: 375.00-376.00 * few (IA, NE)

Canadian Dollar

0.39

Markets pricing in optimism

The market heading into 2022 looks positive, but unfortunately, high feed costs have taken a bite out of calf and feeder prices. The fall cattle market had its share of challenges. Ample fed supplies kept fed prices relatively flat to start the fourth quarter, cow prices hit some of the lowest prices in over 10 years this fall, and calf and feeder prices have been under pressure. Although fed prices have not been high enough for feedlots to be profitable, fed prices are near the second highest on record for the fall period with prices only below 2014 and about inline with 2015. Calf prices were generally trending lower through the fall. The lowest weekly 550 lb steer calf prices were $203.78/cwt. This was the second lowest fall calf prices since 2014, with only 2016 having lower prices. Although fed prices are still relatively strong compared to historical levels, calf prices are under pressure because feed costs are well above any past record high values, and drought has added additional volume to the fall run. Calf prices could have been even lower if the 2022 cattle futures weren’t trading as strong as they are.

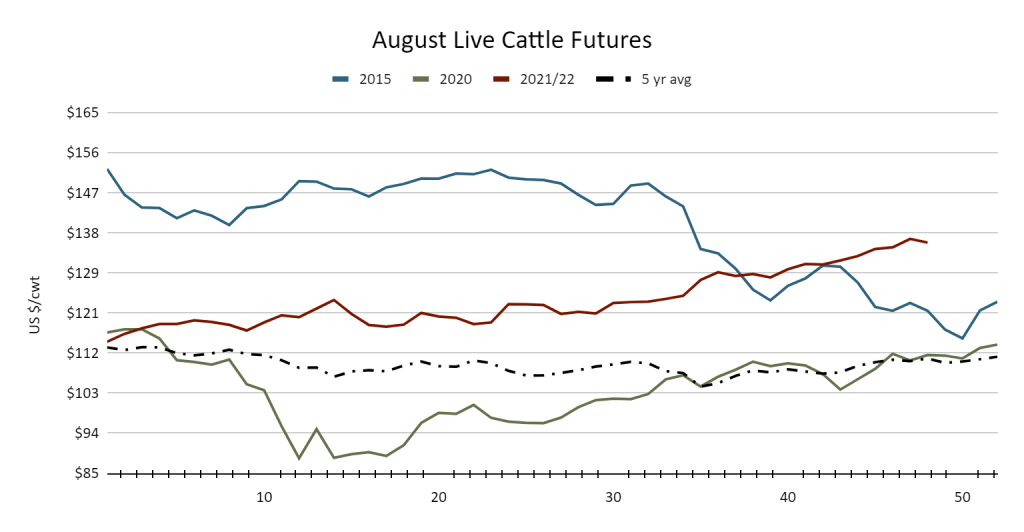

The August live cattle futures have traded at the highest since 2015 but are well above where they were in the fall of 2015. August live cattle futures are near US$137, whereas a year ago they were US$111, and in 2019 were US$115/cwt. In 2015 for this same week, they were US$122, and in 2014 the record highs were US$158. At the time of writing, April feeder cattle futures had traded up to US$172/cwt. This is also the highest price since the fall of 2015 for the April feeder contract.

These high futures prices are offsetting the high grain prices. If the August futures were the same as 2019 at $115/cwt, and you held all other current market factors the same, 550 pounds steer calf prices would be $70/cwt lower than current prices ($131/cwt). On the other hand, if we were to change feed grain costs from current prices of around $420/tonne, to the five year average of $250/tonne, and left all other market conditions the same, calf prices would be projected around $75/cwt higher this fall.

Although there is optimism moving forward, the market is already pricing in higher prices for 2022. While there could be opportunity for higher calf prices, feed costs remain a challenge. Strong futures markets can provide risk management opportunities through hedging or price insurance, which is important to follow.

This article was first published in Volume 2 Issue 1 of ABP Magazine (January 2022). Watch for more digital content from the magazine on ABP Daily.