AB Direct - Steers

Rail: ---

AB Direct - Heifers

Rail: ---

US Trade- Steers

Rail: ---

US Trade - Heifers

Rail: ---

Canadian Dollar

0.01

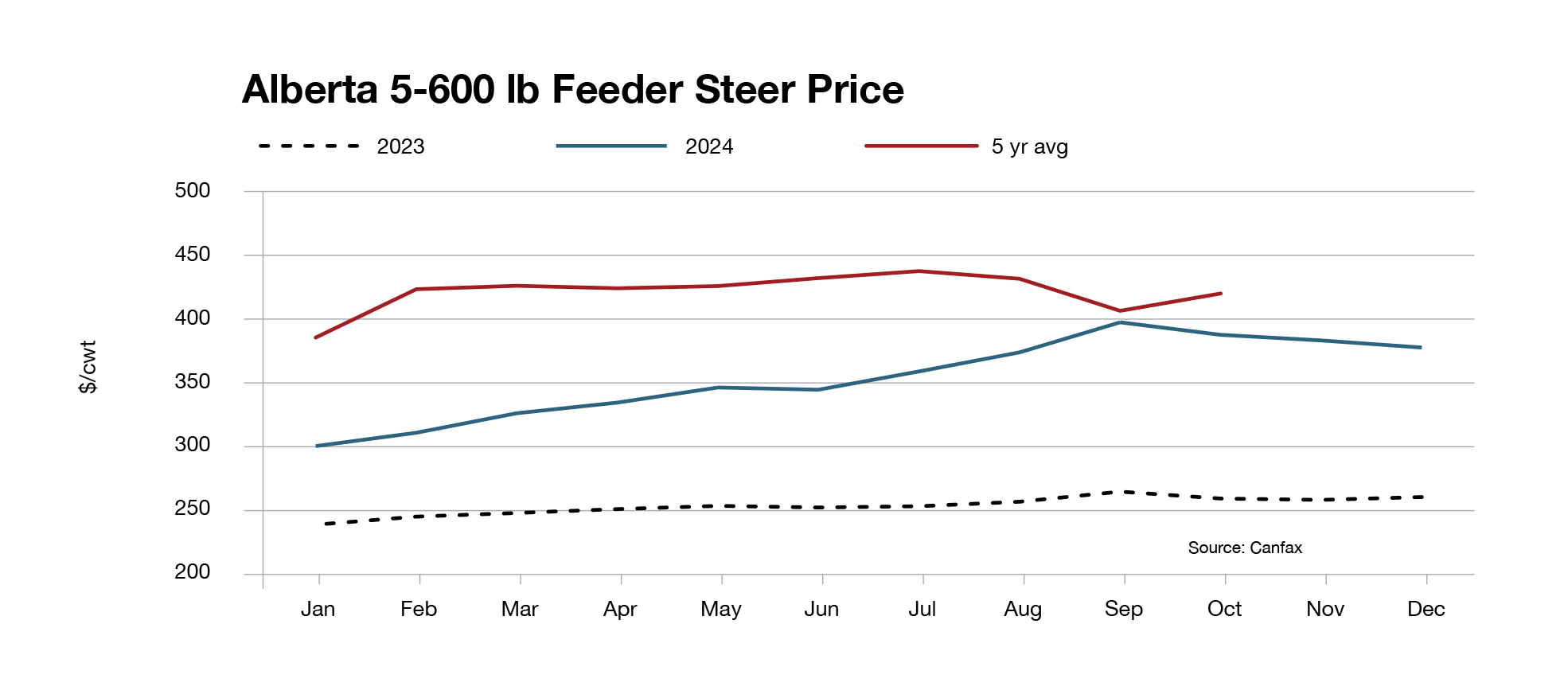

Smaller fall auction volumes provide rebound in feeder prices

Alberta auction volumes from August through October were 18 per cent smaller than last year and 6 per cent smaller than the five-year average. Across western Canada, auction volumes were 13 per cent smaller than last year and 2 per cent smaller than the five-year average. Tighter supplies have shown up all year long, with weekly volumes in the west being smaller than last year for 26 out of the previous 29 weeks. In addition, electronic sales from August to October were 46 per cent smaller than last year.

Historically, calf prices put in their annual peak in September, just as the fall run ramps up, but that was not the case this year. Alberta 550-lb steers found headwinds beginning in July, with a general softening tone throughout the third quarter. By September, Alberta steer calves bottomed just above last year’s annual high set in September. Optimism entered the market in October with prices rebounding 8 per cent higher than September to $421/cwt, to be $33/cwt above last year. Momentum carried into the first half of November, with steer calves once again putting in solid week-over-week gains, most recently climbing above $443/cwt for the first time and establishing a new all-time record high, $3/cwt higher than the previous record set the first week of July.

September was also a softer month in Ontario for 550-lb steer calves after they put in record-high prices in August. Steer calves were largely rangebound at $415/cwt between the beginning of September and the second half of October but broke above $430/cwt in November to be $49/cwt higher than last year. However, they remain 5 per cent below their August high.

U.S. 550-lb steers were under pressure for most of the third quarter but found some tailwinds to begin the fourth quarter. They moved 4 per cent higher between the end of September and the middle of November, plateauing near USD 295/cwt, USD 10/cwt higher than last year. U.S. 550-lb steers are nearly 10 per cent below their record high set in March 2024.

Between August and October, Alberta calf prices were at a $5/cwt discount to Ontario, while the U.S. was at a C$20/cwt discount to Alberta over the same period. This may have encouraged feedlots in Alberta to look south to source feedlot replacements.

For ongoing market analysis and to become a Canfax member, visit www.canfax.ca

This article was first published in Volume 4 Issue 4 of ABP Magazine (December 2024). Watch for more digital content from the magazine on ABP Daily.