AB Direct - Steers

Rail: 496.00-500.00 del

AB Direct - Heifers

Rail: 496.00-500.00 del

US Trade- Steers

Rail: 365.00-372.00 (IA, NE)

US Trade - Heifers

Rail: 365.00-372.00 (IA, NE)

Canadian Dollar

0.10

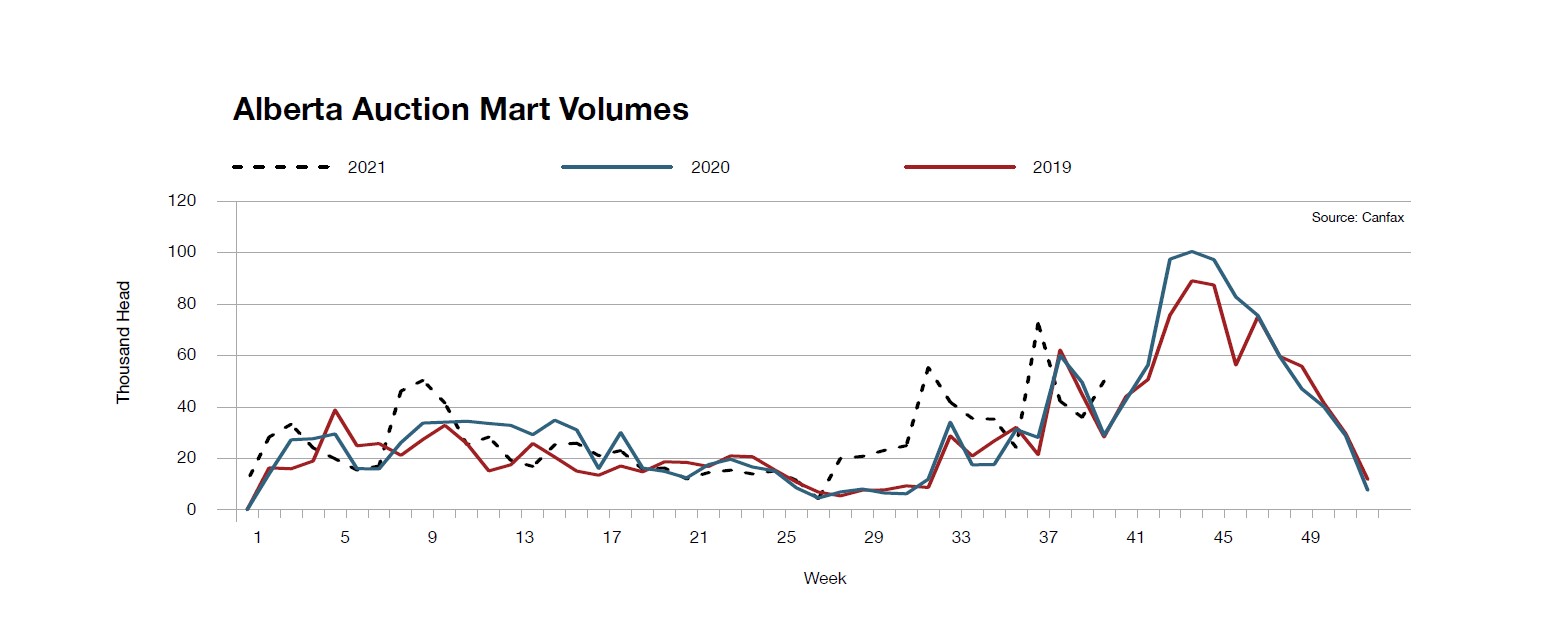

Fall run market factors

The dry weather this summer certainly impacted many producers’ marketing and winter feeding plans, but there was also some welcome moisture relief earlier this fall that took pressure off cow culling and allowed for a bit more orderly fall run of calves. That said fall offerings are larger, as less producers are backgrounding their calves and they will send more heifers to town. Logistics become critical during the fall run and can impact calf prices from week to week as truck availability or the ability for feedlots to process all the incoming calves in a tight timeframe can reduce the demand for calves.

Despite the drought and record high feed grain costs this year, calf prices through to the time of this writing in early October, have been holding higher than last year and 2019, but are facing some fall pressure as they normally do heading deeper into October and possibly into November as well. Calf prices will be dependent on the volume of calves and feedlot demand. If fed prices can strengthen into the fourth quarter that would bode well for calves, but the live cattle futures for next summer will also be important to watch. There was a lot of optimism priced into the market at the start of September, with August 2022 futures trading almost up to US$135/cwt, over US$10 higher than 2021. The market was softer through most of September with August futures bottoming around US$127/cwt. By early October futures had recovered back to around US$131/cwt. This kind of volatility could add risk to the calf market this fall. On the other hand, if futures continue to strengthen, it could result in an earlier fall low for calf prices. It’s always critical to know what the trends are for fed prices, cattle futures and the Canadian dollar to set some price expectations for your calves or if deciding to possibly retain ownership. Strong demand and smaller cattle numbers to come is adding fuel to the cattle futures, but with drought causing more cows and heifers to go to market, and capacity constraints at the packing sector, it is difficult to predict just when or if cash cattle prices will hit the anticipated prices next year. Therefore, risk management is critical. When markets are volatile, and especially if futures markets are pricing in optimism well above current prices, price insurance may be a good and simple risk management tool to protect the equity in your cattle.

For more ongoing market information please visit www.canfax.ca.

This article was first published in the November 2021 edition of ABP Magazine. Watch for more digital content from the magazine on ABP Daily.