AB Direct - Steers

Rail: 496.00-500.00 del

AB Direct - Heifers

Rail: 496.00-500.00 del

US Trade- Steers

Rail: 365.00-372.00 (IA, NE)

US Trade - Heifers

Rail: 365.00-372.00 (IA, NE)

Canadian Dollar

0.10

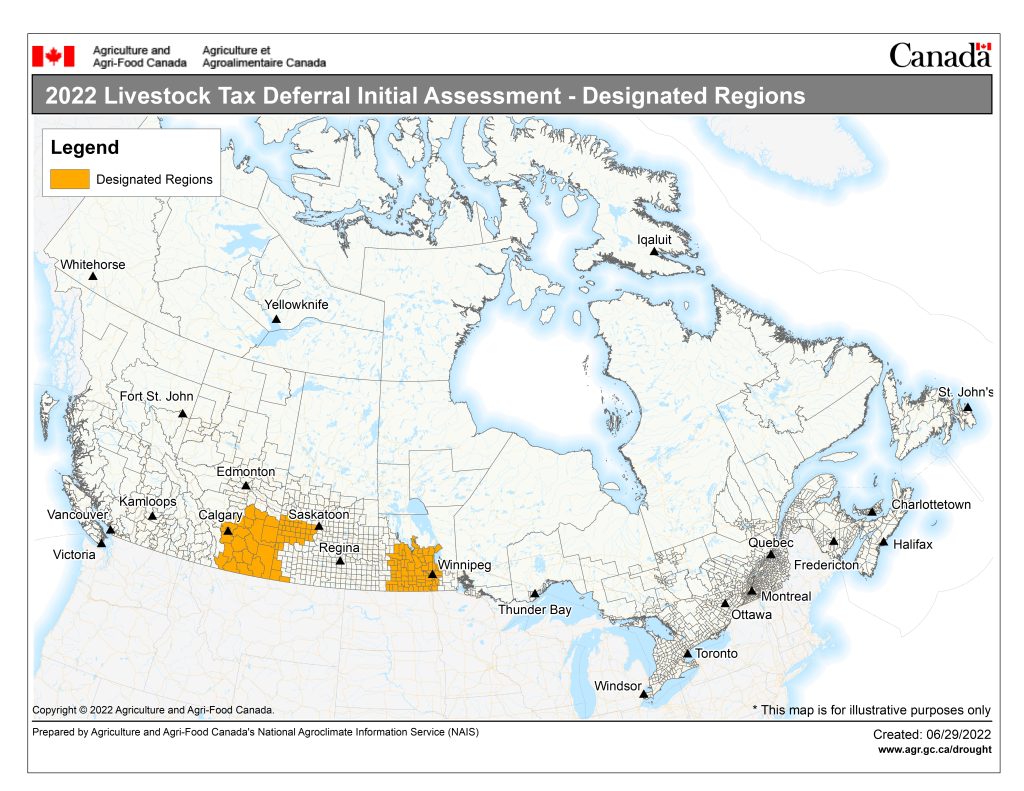

Initial regions for Livestock Tax Deferral provision announced

The Government of Canada has declared the initial regions eligible for the Livestock Tax Deferral provision for 2022, including a large portion of Central and Southern Alberta.

“Canada’s producers continue to show remarkable resilience as they face challenges and uncertainty due to extreme weather conditions,” says Minister of Agriculture and Agri-Food Marie-Claude Bibeau. “Designation of the Livestock Tax Deferral provision provides farmers with the resources needed to make informed decisions and focus on rebuilding their herd and their operations.”

Eligible regions were identified based on weather, climate and production data. This includes areas that saw forage shortfalls of 50 percent or more due to drought or excess moisture.

“Any tool that can alleviate some of the pressures is super important,” says Craig Lehr, a delegate with Alberta Beef Producers. “Especially in the deep south here, we’re seven, eight years into this drought now. And, you know, a lot of producers are kind of at the end of the rope as far as being able to sustain the herd. So this definitely takes the pressure off. And, sadly, a lot of cases, it gives people more time to make the decision whether they want to continue on or not.”

Eligible producers must have reduced their breeding herd by at least 15 percent to defer income. Where the breeding herd is reduced by 15-30 percent, 30 percent of income from net sales can be deferred. Where the breeding herd has been reduced by more than 30 percent, 90 percent of the income from net sales can be deferred.

That deferral of income may also be at least partially offset by the costs of reacquiring breeding animals.

For those in a consecutive year of an eligible region, sales income can continue to be deferred until the first year the region is no longer prescribed.

For questions related to calculating and/or reporting income deferral for Prescribed Drought/Flood Regions for income tax purposes, contact the Canada Revenue Agency (CRA) or consult the CRA publication T4002 Self-employed Business, Professional, Commission, Farming, and Fishing Income, Chapter 2 Income. The Livestock Tax Deferral information is detailed in Line 9470 – Livestock and animal products revenue.